maryland student loan tax credit deadline

Tax Resource Center The tax function is transforming. Child and dependent care credit.

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk

To find out about what about an exemption is.

. SoFi is a leading online loan servicer that offers student loan consolidation and refinancing for undergraduate graduate medical student and Parent Plus loans. We cover any subject you have. But several states tax codes do count canceled student loans as income according to an updated analysis from the Tax Foundation.

Set the deadline and keep calm. NSLDS Student Access provides a centralized integrated view of Title IV loans and grants so that. Center for Business Innovation When it comes to business innovation is changing everything.

15 to apply for a Student Loan Debt Relief Tax Credit of up to. Stay abreast of legislative change learn about emerging issues and turn insight into action. In most jurisdictions bankruptcy is imposed by a court order often initiated by the debtor.

Department of Educations EDs central database for student aid. Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks. This marginal tax rate means that.

Global Business Resource Center The insights and advice you need everywhere you do business. Urban High School Student. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Federal policymakers and institutions need new ways to measure how well borrowers are prepared for success in the labor market. This was exactly what I needed. Individuals who earned less than 125000 in either 2020 or 2021.

Thats because eliminating up to 20000 in debt could constitute a major decrease in your total debt balance which accounts for 30 of your FICO score. A tax deadline extension is an automatic 6-month extension that gives you more time to file your taxes if youre unable to meet the typically mid-April deadline. Maryland offers a tax credit of up to 1000 per year for renters age 60 and up or 100 disabled.

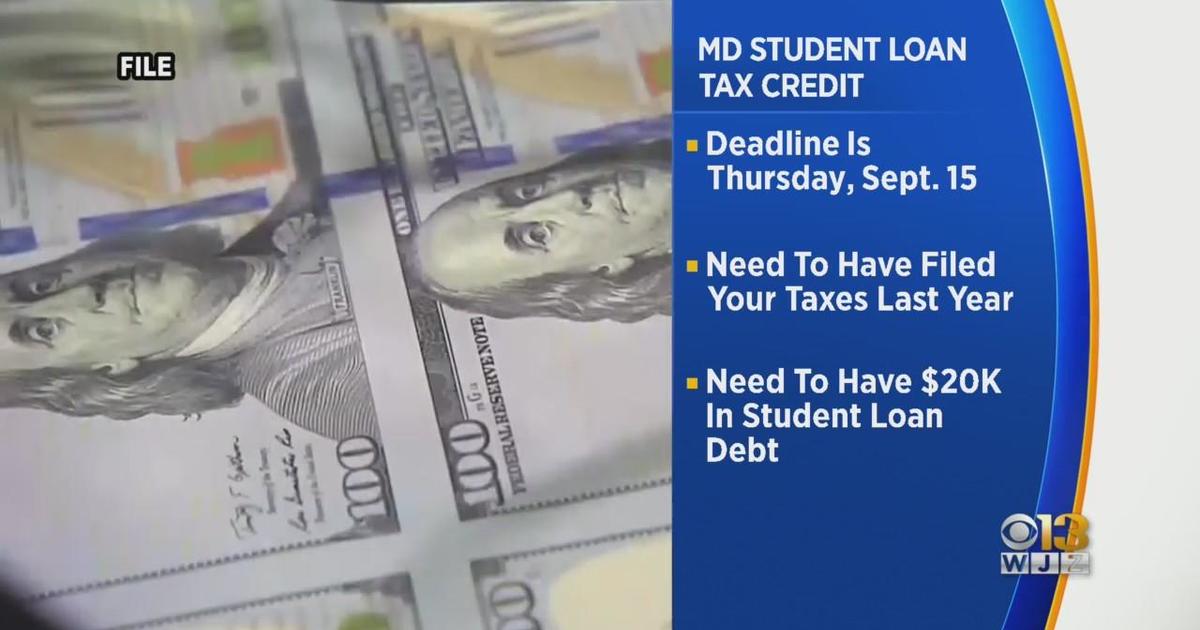

The deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is coming up in just over two weeks. If you make 70000 a year living in the region of Arizona USA you will be taxed 10973. Student Loan Debt Relief Tax Credit.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. This is an optional tax refund-related loan from MetaBank NA. 4 I NCREASED CREDIT FOR CERTAIN SMALL EMPLOYERSIn the case of an employer which would be an eligible employer under subsection c if section 408p2Ci was applied by substituting 50.

People living in Maryland still have time to apply for a Student Loan Debt Relief Tax Credit that will give them up to 1000. Member perks include career coaching free access to a college cost comparison tool free access to personalized financial planning advice and a referral program that pays you and the. Claim or change a foreign tax credit.

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. T he deadline for Maryland residents to claim a Student Loan Debt Relief Tax Credit of up to 1000 is just over one week away. For some borrowers that could hike their state tax bills by up to 985 for 10000 of forgiven loans and ostensibly more for those borrowers who received Pell Grants and are eligible for 20000 worth of.

For 2022 the tax deadline for individuals was on April 18th and for 2023 the date falls on April 17th. You can file Form 4868 before the deadline to receive the automatic. You must claim Maryland residency for the 2022 tax year.

Thank you so much. It is not your tax refund. The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit.

Eligible people have until Sept. H and R block Skip to content. The National Student Loan Data System NSLDS is the US.

The deadline for the states Student Loan Debt Relief Tax Credit. Loans are offered in amounts of 250 500 750 1250 or 3500. The deadline for Maryland residents to claim a Student Loan.

Receive your papers on time. College graduates that attended a Maine school and decide to live and work in the state can get reimbursed for their student loan payments via income tax credits up to an annual maximum. The program offers an income tax credit to residents who make payments on loans from an accredited.

Comparison of Education Advancement Opportunities for Low-Income Rural vs. Find the filing deadline for an amended tax return with help from with tax experts at HR Block. Bankrupt is not the only legal status that an insolvent person may have and the term bankruptcy is therefore not a synonym for insolvency.

The student loan repayment pause has made data measuring the share of borrowers who default on their debts nearly meaningless. Eligible people have 11 days to apply for the tax credit aimed at. However if you dont file a return to claim your refund within three years of your returns due date you.

Deadline Looming To File Late Pandemic-Era Tax. You dont have to worry about paying a penalty for filing a late return after the tax deadline. Any Deadline - Any Subject.

Marylands tax credit program for student loan debt relief has been in existence since 2017. Marylanders paying off their student loans still have time to apply for debt relief to help lessen the amount they still owe. The Biden administrations long-anticipated Student Loan Debt Relief plan was finally announced on August 24 2022 and with it came a flurry of attention on the proposals centerpiece of providing 10000 of student loan forgiveness for Federal student loan borrowers and 20000 for borrowers who received a Pell Grant for college with.

NSLDS receives data from schools guaranty agencies the Direct Loan program and other Department of ED programs. How much money is the Maryland Student Loan Debt Relief Tax Credit. For some people student loan forgiveness could actually lead to a higher credit score.

Announced in late August the plan will deliver federal student loan forgiveness to millions of low- and middle-income borrowers. A Increase in credit percentage for smaller employers Section 45Ee of the Internal Revenue Code of 1986 is amended by adding at the end the following new paragraph. Your average tax rate is 1198 and your marginal tax rate is 22.

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Stimulus Update Deadline For 1 000 One Time Direct Check Payment Is Tomorrow Washington Examiner

Maryland Student Loans Debt Statistics Student Loan Hero

Free Tax Filing See If You Qualify Turbotax Free Edition

Pslf Waiver Relaxed Loan Forgiveness Rules Expire In Soon Money

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

E Cohen Cpas Ecohencpas Twitter

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

Need Help Paying For College Have I Got A Tax Credit For You Opinion Cecildaily Com

Need Help Paying For College Have I Got A Tax Credit For You Opinion Cecildaily Com

Student Loan Interest Deduction Md Tax

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

Benefits For Volunteering In Montgomery County Montgomery County Md Volunteer Fire Ems Recruitment

Is Student Loan Forgiveness Taxable It Depends Conduit Street

What Is The Pass Through Tax Deduction The Ascent By Motley Fool