santa clara property tax rate 2021

Low Value Ordinance The Assessor introduced the low valueminimum assessment ordinance adopted by the Board of Supervisors which provides property tax relief to thousands of small businesses. Mansfield isd service records.

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Unsure Of The Value Of Your Property.

. FY2019-20 PDF 198 MB. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Tax Rate Book Archive.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value. As of June 18 2021 the internet website of the California Department. It also limits property tax increases to a maximum of 2 percent per year on properties with no change of ownership or that did not undergo new construction.

Soundcore life a2 nc firmware update. The ordinance is aimed at assisting taxpayers in which. The County will still assess a 10 penalty plus 2000 cost for unpaid taxes beyond the property tax delinquency date.

Click here to find other recent sales tax rate changes in California. Property Tax Rate Book Property Tax Rate Book. 1 Maximum Tax Levy 100000 Santa Clara County.

In Santa Clara County it is customary for sellers to pay for the county tax 110 per 1000. Santa Clara County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited. County of Santa Clara.

Santa clara county property tax due date 2022. The County of Santa Clara for the Fiscal Year 2020-2021. Property Tax Distribution Charts Archive.

Santa Barbara campus rate is 775 8750. Ad View Property Appraisals Deeds Structural Details for Any Address in Santa Clara. 2021 Proposition 19 supersedes existing law and permits eligible homeowners defined as over 55 severely disabled or whose homes were destroyed by wildfire or disaster to transfer their primary residences property tax base value to a replacement.

Tax rates can be complicated even without a lack of transparency so it is easier to look at the tax rate as a percentage of property value. Additional information can be found on the Smokefree Santa Clara page. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

This leaves an unpaid balance of 2000. All Taxing Agencies. It limits the property tax rate to 1 percent of assessed value ad valorem property tax plus the rate necessary to fund local voter-appr oved debt.

Scsu academic calendar 2021-2022. Mountain View Palo Alto and San Jose all charge an additional city transfer tax of 330 per 1000. Compilation of Tax Rates and Information.

The minimum combined 2022 sales tax rate for Santa Clara California is. The document including the notary. Application forms for Proposition 19 are required to be submitted to the Assessor in which the replacement property is located.

The Santa Clara sales tax has been changed within the last year. Besides Intel and Nvidia other big employers in. The average effective property tax rate in Santa Clara County is 075.

Skip to main content How do I. 3 Page City Rate County Blairsden 7250 Plumas Blocksburg 7750 Humboldt Bloomington 7750 San Bernardino Blossom Hill 9125 Santa Clara Blossom Valley 9125 Santa Clara Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt. 1 day agoAbout 50 companies have 500 or more employees in Santa Clara and pay that top rate according to a 2021 presentation put together by city staff.

Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. FY2020-21 PDF 150 MB. The ordinance exempts from taxation all business property where the aggregate assessed value is less than 10000.

Within Santa Clara County Proposition 60 Please be advised that on November 3. It was raised 0125 from 9 to 9125 in July 2021 and raised 0125 from 9 to 9125 in July 2021. Find All The Assessment Information You Need Here.

Nigeria labour congress logo. The County sales tax rate is. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction. COUNTYWIDE 1 PROPERTY TAX DISTRIBUTION FY2020-21 Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. The Santa Clara sales tax rate is.

Typically buyers and sellers split city transfer tax 5050. This is the total of state county and city sales tax rates. However this penalty will apply only to the balance due.

California City and County Sales and Use Tax Rates. The California sales tax rate is currently. Property Tax Distribution percentages for the County of Santa Clara.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. County Retirement Levy 003880. The median property tax on a 70100000 house is 518740.

A non-refundable processing fee of 110 is required in Santa Clara County. Tax Rates are expressed in terms of per 100 dollars of valuation. FY201718 PDF 137 KB.

FY2019-20 PDF 198 MB. For example lets say your first property tax installment is 5000 and by December 10th you elect to pay 3000 of it. The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

New braunfels theater plays. Checks should be made out to County of Santa Clara. Close SCCGOV Menu.

Search for individual property tax rates using. 1788 rows Santa Clara. Effective 1012021 through 12312021.

Credit card payments for the processing fee are accepted in person at our office.

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

Property Taxes Department Of Tax And Collections County Of Santa Clara

Pin By Robert Paul On My Style Installing Insulation Fiberglass Batts Home Builders

Top 10 Sfr Growth Counties With Greatest Annual Increases Attom

Secured Property Taxes Treasurer Tax Collector

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

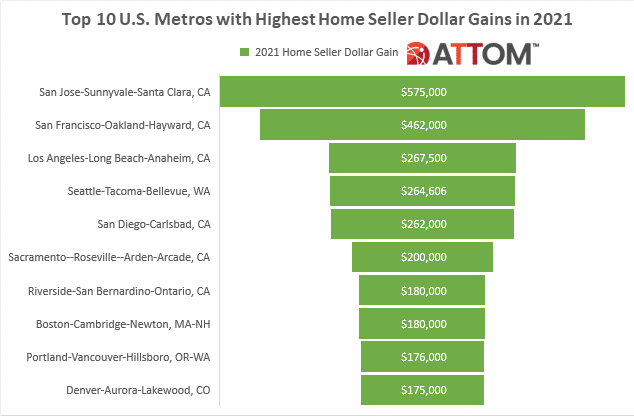

Top 10 U S Metros With Highest Home Seller Profits In 2021 Attom

Secured Property Taxes Treasurer Tax Collector

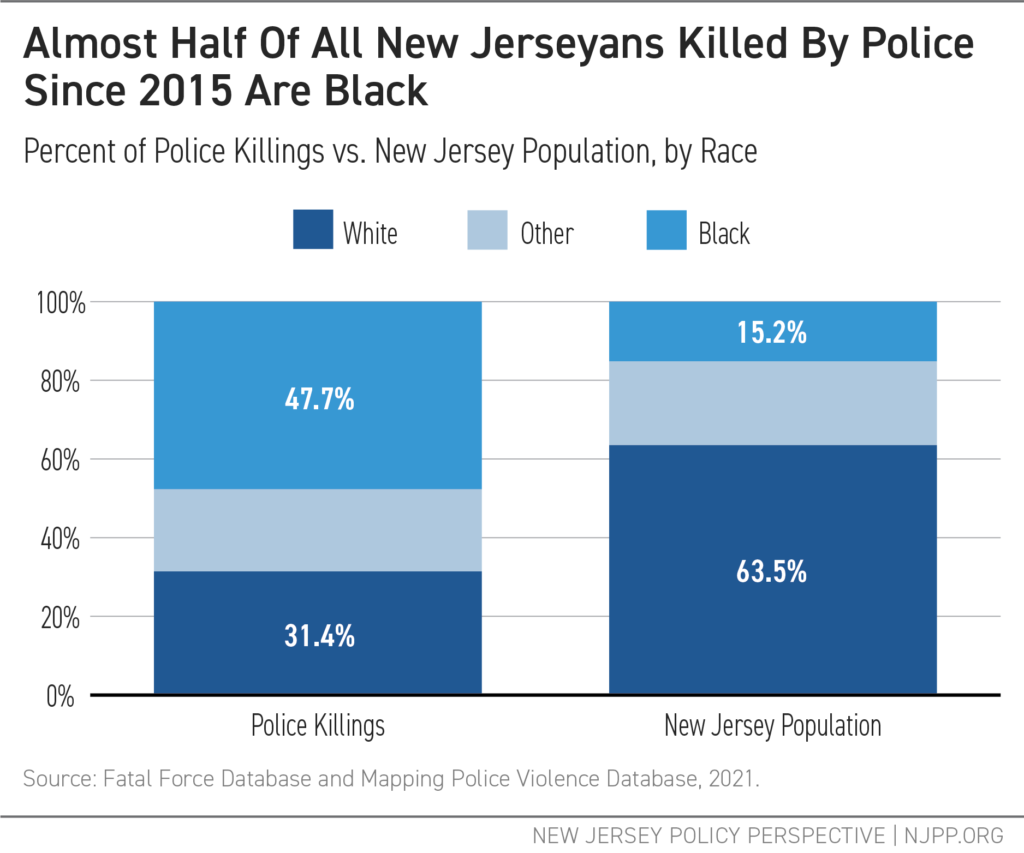

Report Archives New Jersey Policy Perspective

Santa Clara County Ca Property Tax Calculator Smartasset

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Taxes Department Of Tax And Collections County Of Santa Clara

Top 10 U S Metros With Highest Home Loan Down Payments Attom

Santa Clara County Property Value Increases In 2021 San Jose Spotlight